Financial Services Cloud vs. Sales Cloud: When (and Why) to Make the Switch

- Ohana Focus Team

- 1 day ago

- 12 min read

Many financial services firms end up on Sales Cloud not because someone chose it, but because it was already there. The firm adopted Salesforce years ago, built out its sales process on the standard platform, and it kept growing. It works—mostly. Advisors manage their pipelines, teams log calls, and managers pull reports. Nobody is complaining loudly enough to justify a major overhaul.

But over time, the gaps start to show. The data model wasn't built for households or financial accounts. Compliance tracking is held together with custom fields and workarounds. Reporting on AUM requires manual exports. The client profile shows contact information but not the full relationship picture an advisor needs before a meeting. And every time a new regulatory requirement lands, someone has to figure out how to make a generic CRM do something it was never designed to do.

Financial Services Cloud exists to solve exactly these problems. But migrating from Sales Cloud to FSC isn't a decision to take lightly—it's a significant undertaking with real costs and complexity. This post gives you an honest framework for evaluating whether the switch makes sense for your firm, what you actually gain (and give up), and how to approach the decision without oversimplifying it.

Understanding What FSC Actually Is (and What It Isn't)

Before comparing the two platforms, it's worth clearing up a common misconception: Financial Services Cloud isn't a completely separate product from Sales Cloud—it's Salesforce built on top of the core Sales Cloud platform, with a purpose-built data model and a set of pre-configured features layered on for financial services use cases.

That distinction matters for two reasons. First, it means FSC inherits everything good about Sales Cloud—the pipeline management, workflow automation, reporting engine, AppExchange ecosystem, and the overall platform capabilities you already know. You're not starting over; you're moving to a more specialized foundation. Second, it means FSC isn't magic. You still have to configure it, maintain it, and train your team on it. The specialized data model creates real advantages, but only if it's implemented correctly.

What FSC adds on top of Sales Cloud includes a financial-services-specific data model (Person Accounts, Financial Accounts, Households, Life Events, Goals, Referrals), pre-built components for advisor and branch workflows, Actionable Relationship Center (ARC) for visualizing complex client relationships, Financial Deal Management for M&A and corporate banking use cases, and compliance-friendly features like interaction summaries and Know Your Customer (KYC) tracking. These aren't things you can easily replicate in Sales Cloud with customization (at least not without significant effort and ongoing maintenance cost).

Where Sales Cloud Falls Short for Financial Services

Organizations running financial services operations on Sales Cloud tend to hit the same walls. The specific pain points vary by firm type, but certain themes come up consistently in our work with wealth management firms, banks, insurance companies, and credit unions.

The Household Problem

Standard Sales Cloud is built around the Account-Contact relationship model: a company (Account) has people associated with it (Contacts). This works well for B2B sales. It works poorly for financial services, where the meaningful unit is often a household—a married couple, a family, a business owner and their related entities—with multiple financial relationships and shared goals that need to be managed together.

Firms on Sales Cloud typically handle this with custom Account hierarchies, creative use of Contact relationships, or custom objects that approximate household functionality. These workarounds function, but they require constant maintenance, they don't play nicely with standard Salesforce reporting, and they break down when new advisors join and don't understand the custom logic.

FSC's native Household model solves this cleanly. Households roll up financial accounts, AUM, and interaction history from all related individuals. Relationship maps show family structures visually. Household-level reporting works out of the box. What takes months to build and maintain as a workaround in Sales Cloud exists natively in FSC.

Financial Account Visibility

Sales Cloud has no native concept of a financial account—a checking account, brokerage account, insurance policy, or retirement plan. Firms either store this information in custom objects with limited visibility, pull it from external systems without real integration, or maintain it entirely outside of Salesforce and accept that advisors have to log into multiple platforms to prepare for a client conversation.

FSC's Financial Account object is purpose-built for this. It supports different account types with appropriate fields for each, links directly to clients and households, rolls up into AUM calculations, and integrates cleanly with portfolio management systems and core banking platforms. The client profile in FSC shows financial relationships; the client profile in Sales Cloud shows a contact record with whatever custom fields someone decided to add.

Compliance and Regulatory Tracking

Financial services firms operate under regulatory requirements—suitability, fiduciary standards, KYC, AML, interaction documentation—that generic CRM platforms weren't designed to support. Sales Cloud can technically store compliance-related information, but making it actually work for regulatory purposes typically requires significant custom development that's expensive to build and fragile to maintain as requirements evolve.

FSC has compliance-friendly features built in: interaction summaries that document advisor-client communications in a regulatory-appropriate format, KYC and suitability tracking, and Financial Services Shield (available as an add-on) for more comprehensive data governance and audit trail capabilities. These still require configuration—FSC is not a compliance system out of the box—but the foundation is appropriate to the regulatory environment in a way that Sales Cloud fundamentally is not.

Referral Management

In financial services, referrals are a primary growth driver—and tracking them properly is both a business necessity and, for some firms, a regulatory requirement. Sales Cloud has no native referral tracking. Firms typically track referrals through opportunities, custom fields, or external systems, none of which give management clear visibility into referral flow, conversion rates, or advisor performance on referrals.

FSC has native referral management that connects referrals to specific advisors, households, and financial goals. It tracks where referrals come from, where they go, and what happens to them. For firms where referrals drive significant business, this alone can be a compelling reason to make the switch.

The Honest Case for Staying on Sales Cloud

Not every financial services firm should migrate to FSC. We believe in giving clients an honest assessment, which means acknowledging the situations where staying on Sales Cloud makes more sense than switching.

If your firm's primary use of Salesforce is B2B sales—selling financial products to corporate clients, managing institutional relationships, or running a distribution operation where the relationship is company-to-company rather than advisor-to-individual—Sales Cloud's native data model may actually be a better fit than FSC. FSC's Person Account model creates friction in pure B2B contexts.

If your current Sales Cloud implementation is heavily customized and working well, the migration cost may outweigh the benefit. Migrating from Sales Cloud to FSC isn't just a license swap—it requires rethinking your data model, rebuilding custom objects and workflows, retraining your team, and managing the data migration itself. If those customizations have taken years to build and are genuinely meeting your needs, a careful cost-benefit analysis may favor incremental improvement over a full migration.

If your organization is small and your CRM needs are straightforward—managing a small book of business, tracking basic client interactions, running simple pipeline reports—Sales Cloud with modest customization may be entirely sufficient. FSC adds meaningful capability for firms with complex household relationships, large advisor teams, or sophisticated compliance requirements. For a boutique operation with twenty clients and two advisors, that complexity may be unnecessary overhead.

Finally, if your organization recently completed a Sales Cloud implementation and is still in the process of driving adoption, this is almost certainly not the right time to migrate. Platform changes are disruptive. A team that is still learning one system does not need to learn a new one.

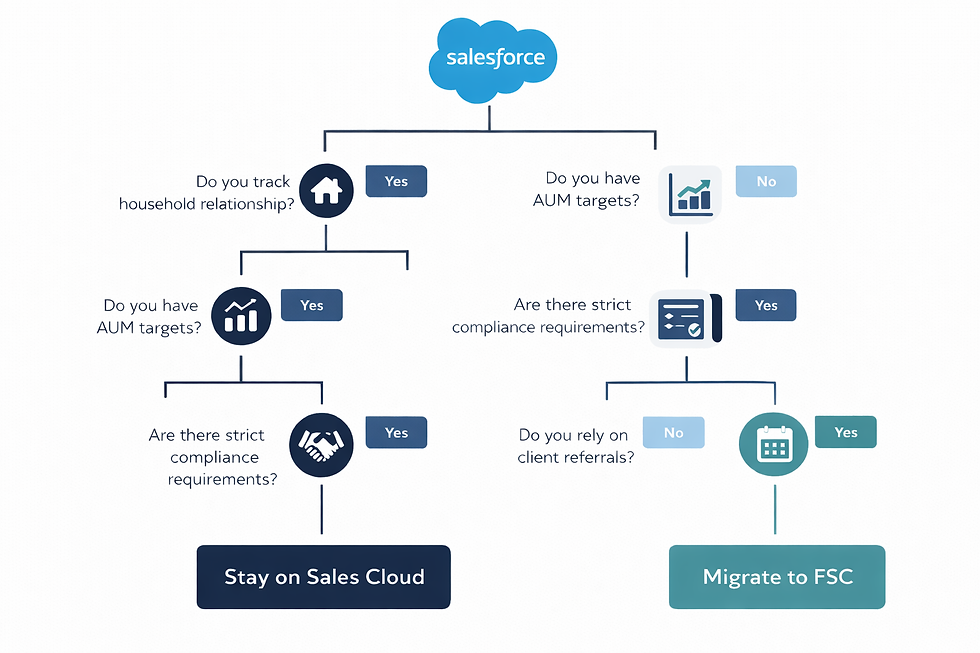

The Decision Framework: Five Questions Worth Asking

1. How much of your business centers on household relationships?

If advisors regularly manage multiple family members, business owners with related entities, or complex household structures—and if understanding the full household picture is important to serving clients well—FSC's household model delivers real, daily value. If most of your client relationships are straightforward individual accounts with no meaningful household complexity, this advantage is less compelling.

2. How much time are advisors spending on workarounds?

Ask your advisors and relationship managers to honestly describe what they do before a client meeting or a portfolio review. How many systems do they log into? How much time do they spend assembling information that should be in one place? If the answer involves pulling data from three systems, running an Excel report, and cross-referencing a separate compliance tracker, the productivity cost of staying on Sales Cloud is real and ongoing. FSC's value shows up in time reclaimed every single day.

3. What is your compliance burden, and is it growing?

Financial services regulation is not getting simpler. If your firm is growing, adding registered advisors, expanding into new product lines, or operating in multiple jurisdictions, your compliance obligations are likely increasing. The cost of managing compliance on a platform that wasn't designed for it tends to grow faster than the firm itself. FSC's compliance-oriented features become more valuable as that burden increases.

4. How important is referral visibility to your growth strategy?

If referrals are a primary driver of new business—and for most wealth management and private banking firms, they are—and if you currently have limited visibility into referral flow, conversion, and advisor performance on referrals, FSC's native referral management addresses a genuine strategic gap. If your firm grows primarily through marketing, inbound inquiries, or institutional channels where referrals are less central, this is a smaller factor.

5. What is your five-year technology trajectory?

FSC isn't just a data model—it's also Salesforce's direction of investment for financial services. New features, AI capabilities through Einstein, industry-specific integrations, and regulatory response tools are being built for FSC first. Firms that stay on generic Sales Cloud will increasingly find themselves at the edge of Salesforce's roadmap for their industry rather than at the center of it. If your firm intends to use Salesforce as a long-term strategic platform, building on FSC's foundation positions you better for what's coming.

What the Migration Actually Involves

Data Model Redesign

The most significant migration work is conceptual, not technical. Your existing Sales Cloud data—Accounts, Contacts, Opportunities, custom objects—needs to be mapped to FSC's data model. Contacts become Person Accounts. Account relationships become Household structures. Financial product information in custom fields gets migrated to Financial Account objects. This mapping work requires both technical Salesforce expertise and deep understanding of your business, because the right design choices depend on how your firm actually operates.

Custom Development Audit

Every custom field, custom object, workflow rule, process builder flow, and Apex trigger in your Sales Cloud org needs to be evaluated. Some will migrate cleanly. Some will be replaced by FSC's native functionality—which is actually a good thing, since native features are easier to maintain than custom code. Some will need to be rebuilt for the new data model. And some may be outdated workarounds that no longer need to exist at all. This audit is unglamorous but essential.

Data Migration

Moving existing data from the Sales Cloud structure to the FSC structure requires transformation logic, deduplication, and validation. The quality of your existing data has a direct impact on migration effort—firms with clean, well-maintained data migrate more smoothly than firms with years of accumulated duplicates and inconsistencies. This is often where migration projects take longer than planned, and it's why we recommend a data audit as one of the first steps in any migration engagement.

Reporting and Dashboard Rebuild

Reports and dashboards built for the Sales Cloud data model won't automatically work in FSC. They need to be rebuilt—but this is also an opportunity. FSC's data model supports reporting that was impossible or cumbersome in Sales Cloud: household-level AUM reports, referral pipeline dashboards, advisor book-of-business summaries, and life event-triggered activity tracking. The rebuild effort is real, but the output is more valuable than what you started with.

Change Management and Training

The technical migration is only part of the project. Advisors who have been working in Sales Cloud for years have ingrained habits and mental models about how their CRM works. FSC looks different, navigates differently, and surfaces information differently. Change management—communicating the why behind the migration, training teams on the new experience, and providing support during the transition—is as important as the technical work. Migrations that skip this investment consistently underperform on adoption.

A Balanced Perspective: What FSC Won't Fix

Migrating to FSC will not automatically solve problems that are rooted in process or behavior rather than platform. If advisors aren't logging client interactions in Sales Cloud because they find it too cumbersome or don't see the value, switching to FSC won't change that unless the new experience is meaningfully better for how they actually work—and unless leadership reinforces the expectation. Platform migrations don't fix adoption problems; they sometimes create an opening to address them, but only with deliberate effort.

FSC is also not a compliance system, and it's important to be clear-eyed about this. It provides tools and structures that support compliance workflows, but it is not a replacement for purpose-built compliance software in highly regulated environments. Firms with sophisticated compliance operations—archiving requirements, surveillance tools, regulatory reporting—will still need those systems alongside FSC. The goal is complementary integration, not replacement.

Finally, FSC is more complex to administer than Sales Cloud. The additional data model sophistication that makes FSC powerful for financial services also means more configuration to maintain, more complexity for Salesforce administrators to understand, and more surface area for things to go wrong. Firms that are already struggling to find and retain Salesforce admin talent should factor this into their decision. FSC rewards investment in skilled administration; it suffers when it isn't properly maintained.

Common Migration Wins We See After the Switch

The pre-meeting preparation transformation

Advisors report that FSC's unified client view—household relationships, financial accounts, recent interactions, life events, and goals all on one screen—changes how they prepare for client meetings. What previously required pulling from multiple systems now takes a single glance.

AUM reporting accuracy

Firms that previously couldn't reliably report AUM at the household level gain immediate visibility into book-of-business composition, concentration risk, and advisor performance in ways that weren't possible before.

Referral accountability

Management teams gain the ability to see referral flow and conversion in real time, identify which advisors are strong referral sources, and spot referrals that are falling through the cracks.

Compliance documentation efficiency

Interaction summaries and KYC tracking reduce the manual effort of documenting client communications in a compliant format, which is particularly valuable as advisor headcount grows.

New advisor onboarding

When an advisor joins or transitions a book of business, FSC's household and relationship model makes it significantly faster to understand the full client relationship rather than piecing it together from disparate records.

Actionable Next Steps If You're Evaluating the Switch

Document your current pain points specifically

Before talking to anyone about migration, write down the five to ten most significant ways your current Sales Cloud implementation is failing your advisors or management team. Be concrete. 'We can't easily see household-level AUM' is useful. 'The CRM isn't great' is not. Specific pain points allow you to evaluate whether FSC actually solves them.

Audit your current Sales Cloud org

Understand what you've built before you decide what to migrate. How many custom objects, flows, and integrations does your current org have? How much of it is actively used versus legacy configuration that accumulated over the years? This assessment gives you a realistic picture of the migration scope.

Talk to firms similar to yours that have made the switch

Salesforce's reference customer community and consulting partners can connect you with firms in similar situations who have gone through the migration. Their firsthand experience—including what they'd do differently—is more valuable than any product demo.

Request a focused FSC demonstration against your use cases

Rather than a standard product tour, ask Salesforce or a consulting partner to demonstrate specifically how FSC would handle your firm's most common advisor workflows and your specific pain points. Generic demos are less useful than scenarios drawn from your actual business.

Build a realistic business case

Quantify both sides of the ledger. On the benefit side: advisor time saved, improved referral conversion, reduced compliance overhead, and better client retention. On the cost side: migration project fees, license cost differences, internal time, and the productivity dip during transition. A decision this significant deserves a real financial model.

The Right Tool for the Right Job

Sales Cloud is an excellent CRM. It's one of the most capable and widely adopted platforms in the world, and many financial services firms use it effectively. The question isn't whether Sales Cloud is good—it's whether it's the right fit for the specific demands of financial services client relationships, and whether the gap between what you have and what FSC offers is large enough to justify the migration investment.

For firms with complex household relationships, growing compliance obligations, significant referral-driven growth, and a long-term commitment to Salesforce as a strategic platform, the answer is usually yes. The migration is real work—but so is the cumulative cost of workarounds, manual processes, and a CRM that requires your advisors to work around it rather than with it.

The firms that make the switch and invest in doing it well consistently tell us the same thing: they wish they'd done it sooner. Not because Sales Cloud was failing them catastrophically, but because they didn't fully appreciate what they were missing until they saw what FSC could do.

Partner with Ohana Focus

Get clarity on whether FSC is the right move—and expert guidance if it is.

We've helped financial services firms navigate the Sales Cloud to FSC decision honestly—including telling clients when we believe the migration isn't the right call. When it is, we bring deep FSC implementation expertise, financial services domain knowledge, and a practical approach that keeps your advisors productive through the transition. We bring:

Sales Cloud to FSC migration assessment and planning

Data model design and migration execution

Custom development audit and rebuild

FSC configuration and integration with financial systems

Advisor training, change management, and adoption support

Ongoing FSC administration and optimization

About Ohana Focus

Ohana Focus is a certified Salesforce consulting partner dedicated to helping financial services firms get more from their Salesforce investment. We specialize in Financial Services Cloud implementations, Sales Cloud migrations, and the integrations that connect FSC to the systems financial advisors and relationship managers depend on every day. We believe great CRM implementation isn't about the technology—it's about helping your team serve clients better and spend more time on the work that actually matters.

Comments